Why Insurers Prefer Generic Drugs: How Formularies Control Costs and Shape Your Prescriptions

Jan, 27 2026

Jan, 27 2026

Every time you pick up a prescription, the drug you get isn’t just chosen by your doctor - it’s also filtered through a hidden system built by your insurer. This system, called a preferred generic list, determines whether you pay $5 or $200 for the same medicine. It’s not random. It’s calculated. And understanding it can save you hundreds - even thousands - a year.

How Insurers Decide What’s ‘Preferred’

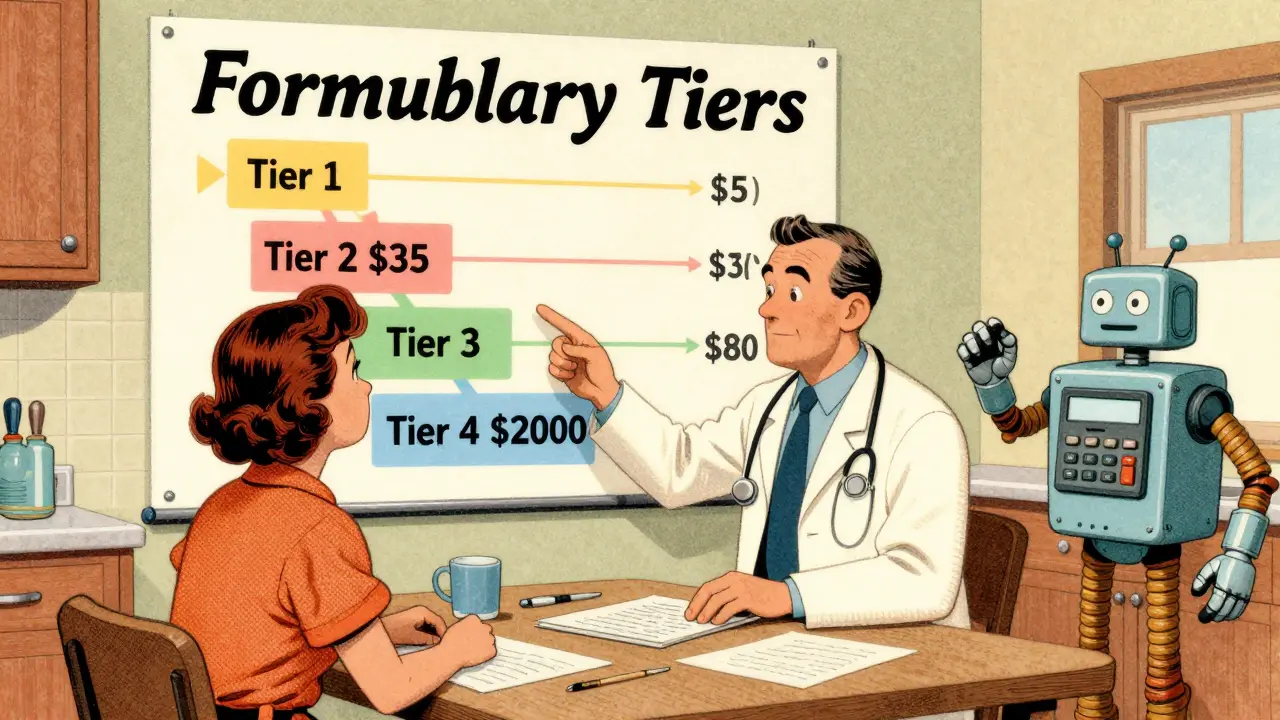

Insurers don’t pick generic drugs because they’re cheaper by accident. They pick them because the math works. A 2022 FDA report showed that generic drugs cost, on average, 80-85% less than their brand-name versions. When six or more companies make the same generic, prices can drop by 95%. That’s not a small saving - it’s a system-wide reset. These lists, called Preferred Drug Lists (PDLs), are created by panels of doctors and pharmacists who review every drug for safety, effectiveness, and cost. They don’t just look at the sticker price. They look at real-world outcomes, how often the drug fails, and whether patients stick with it. If two generics do the same job - like simvastatin and atorvastatin for cholesterol - and one costs $12 a month while the other costs $18, the cheaper one becomes preferred. It’s not about cutting corners. It’s about steering care toward what works without draining resources. In 2023, 98% of commercial health plans and 100% of Medicare Part D plans used tiered formularies. That means your meds are sorted into levels, and your out-of-pocket cost changes depending on which level they’re on.The Tier System: What You’re Really Paying For

Most formularies have four tiers. Here’s how they break down:- Tier 1: Preferred Generics - These are the cheapest. Think metformin, lisinopril, levothyroxine. Copay? Usually $5-$15 for a 30-day supply. This is where insurers want you to be.

- Tier 2: Preferred Brand-Name or Higher-Cost Generics - Slightly more expensive. Copays range from $25-$50. Sometimes a brand-name drug gets here if it has a unique delivery system or better patient adherence data.

- Tier 3: Non-Preferred Brands - These are drugs with generic alternatives, but insurers don’t push them. Copays jump to $50-$100. Your doctor can still prescribe them, but you’ll pay more.

- Tier 4: Specialty Drugs - Biologics like Humira, Enbrel, or insulin analogs. These can cost $500-$3,000 a month. Coinsurance applies - you might pay 30-50% of the price. Some plans even require prior authorization just to start.

When Generics Don’t Work - And Why Insurers Still Push Them

Not all drugs are created equal. For conditions like epilepsy, thyroid disorders, or blood thinners like warfarin, small differences in absorption can matter. The American College of Clinical Pharmacy found that 23% of doctors resist switching patients to generics for these drugs because of stability concerns. Yet insurers still push them. Why? Because the savings are massive. In 2023, generics made up 90% of all prescriptions filled in the U.S. but only 23% of total drug spending. That’s $1.68 trillion saved annually - according to a 2023 JAMA study - just from using generics instead of brands. But here’s the dark side: 1.2% of those substitutions lead to adverse events. That’s about 2 million cases a year, costing $4.7 billion in extra care. That’s why the FDA requires generics to match brand drugs within 80-125% of the same pharmacokinetic profile. Most do. But not all.

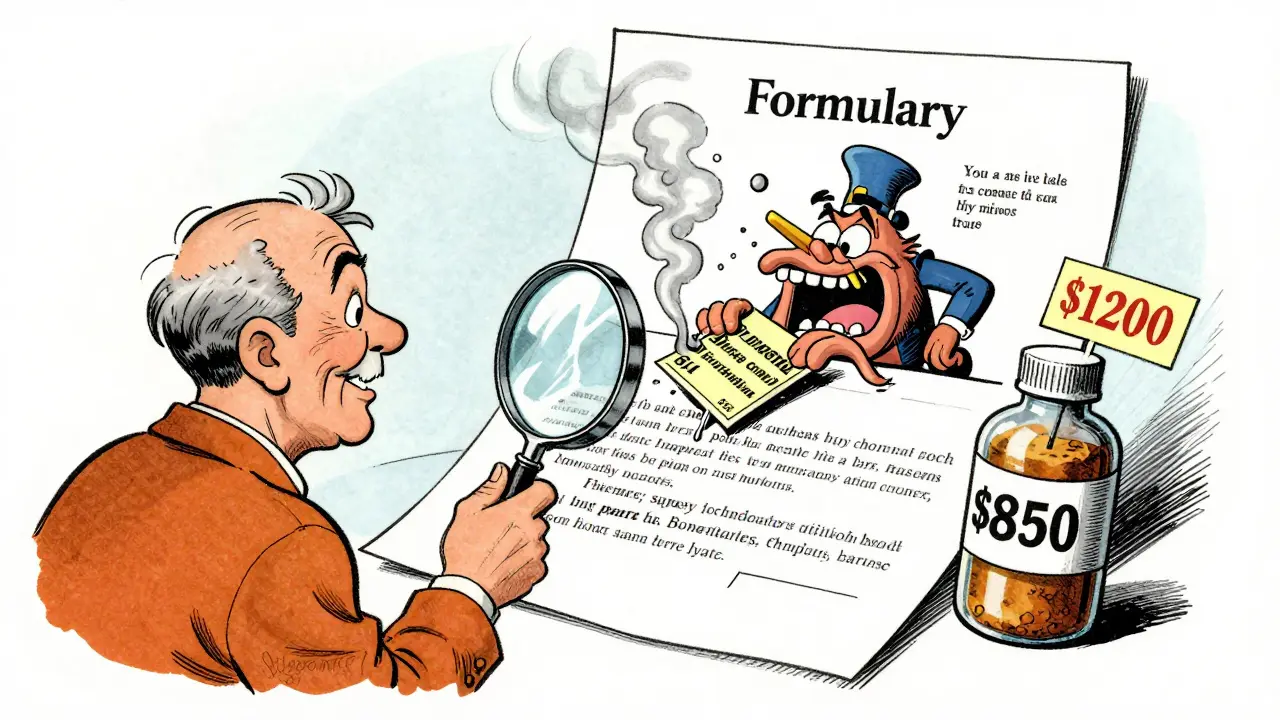

The Biosimilar Trap

Biosimilars are the next wave. They’re cheaper versions of complex biologic drugs like Humira or Enbrel. But they’re not treated like regular generics. In 2023, only 15% of eligible biologic prescriptions switched to biosimilars in the U.S. - compared to 85% in Europe. Why? Because brand-name manufacturers offer co-pay assistance programs that cover hundreds or even thousands of dollars a month. Biosimilar makers? They rarely do. So even though Amjevita (Humira’s biosimilar) costs $850 a month versus $1,200 for Humira, you might end up paying the same out-of-pocket - or even more - because your co-pay card no longer works. Cigna’s 2023 member report found that 44% of patients on biologics struggled with this switch. Insurers put biosimilars in Tier 1, hoping you’ll save. But if you lose your co-pay card, you’re stuck with a lower-cost drug that doesn’t lower your bill.What You Can Do - And What You Shouldn’t Accept

You’re not powerless. Here’s what works:- Check your formulary every year - During open enrollment, log into your plan’s website. Search your meds. See what tier they’re on. If your levothyroxine moved from Tier 1 to Tier 3, switch plans. One user on Reddit saved $175 a month just by switching plans.

- Ask your pharmacist - In 89% of states, pharmacists can automatically substitute a generic unless your doctor writes “dispense as written.” Most patients don’t know this. Ask: “Can you give me the generic?”

- Appeal denials - If your insurer denies a brand-name drug, your doctor can file a prior authorization appeal. Kaiser Family Foundation data shows 68% of these appeals succeed when backed by clinical notes.

- Use GoodRx or SingleCare - Even if your insurance doesn’t cover a drug, these apps often show cash prices lower than your copay. A 2023 survey found 63% of users found better prices this way.

The Bigger Picture: Why This System Exists

This isn’t about greed. It’s about survival. The U.S. spends more on prescription drugs than any other country. In 2023, PBMs processed 5.8 billion prescriptions - 89% were generics. CVS Health, Cigna, and UnitedHealth control 78% of that market. They negotiate rebates, manage pharmacy networks, and design formularies to keep premiums low. The 2022 Inflation Reduction Act is forcing change. By 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 a year. That’s going to push even more people toward generics. And starting in 2025, Medicare will require biosimilars to be placed in the same tier as their brand-name counterparts - a move expected to boost biosimilar use from 15% to 45%. But there’s a catch. In February 2024, 63% of PBMs started using “accumulator adjuster” programs. These let insurers count your co-pay card discounts toward your drug costs - but not toward your out-of-pocket maximum. So you’re paying less now, but it doesn’t help you hit your cap. That’s a loophole that benefits insurers, not patients.What’s Next? Formularies Are Getting Smarter

UnitedHealthcare launched “Value-Based Formularies” in January 2024. Instead of just pricing drugs, they now track real-world outcomes. If a generic for diabetes leads to fewer hospital visits and better HbA1c levels, it moves up. If it doesn’t, it gets demoted. This is the future. Formularies won’t just be about cost anymore. They’ll be about results. But until then, you’re still the one holding the prescription. Know your options. Ask questions. And don’t let a tier system decide your health.Why does my insurance only cover the generic version of my medication?

Insurers cover generics because they’re proven to work just as well as brand-name drugs but cost 80-85% less. By steering patients toward these lower-cost options, insurers keep premiums affordable for everyone. If a generic exists and is FDA-approved as therapeutically equivalent, your plan will typically require you to try it first before covering the brand.

Can I still get the brand-name drug if I want to?

Yes, but you’ll pay more. If your doctor writes a prescription for a brand-name drug that’s not on your plan’s preferred list, you can still fill it - but you’ll likely pay the full non-preferred tier cost, which can be $50-$100 or more. You can also file an appeal with your insurer, and if your doctor provides documentation that the generic caused side effects or didn’t work, there’s a 68% chance your appeal will be approved.

Do generic drugs really work the same as brand-name drugs?

For 98.5% of FDA-approved generics, the answer is yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand. They must also be bioequivalent - meaning they work in your body within 80-125% of the brand’s performance. In most cases, including for high-blood pressure, diabetes, and cholesterol meds, there’s no measurable difference in effectiveness.

Why are biosimilars harder to switch to than regular generics?

Biosimilars are complex biological drugs, not simple chemical copies. Brand-name biologics often come with co-pay assistance programs that reduce your out-of-pocket cost to $0 or $10. Biosimilar makers rarely offer these. So even if the list price is lower, your actual payment might not change - or could even go up. Plus, some insurers use accumulator adjusters that don’t count your savings toward your out-of-pocket maximum, making the switch feel pointless.

How can I find out what tier my drug is on?

Log into your insurer’s website and search for your plan’s formulary. Most have a drug search tool. If you’re on Medicare, use the Medicare Plan Finder tool - it’s rated 4.2/5 for usability. For commercial plans, the average usability score is only 2.8/5, so call customer service if you can’t find it. Ask: “What tier is [drug name] on, and what’s my copay?”

Is it worth switching insurance plans just for better drug coverage?

If you take one or more high-cost medications, absolutely. One patient saved $417 per year just by switching to a plan that put their levothyroxine in Tier 1 instead of Tier 2. That’s $50 a month. If you’re on multiple prescriptions, the savings can be over $1,000 a year. Review your formulary during open enrollment - it takes 45 minutes, but it’s the most effective way to cut drug costs.

Mark Alan

January 27, 2026 AT 20:16matthew martin

January 29, 2026 AT 13:45Katie Mccreary

January 29, 2026 AT 20:20