Indian Generic Manufacturers: The World's Pharmacy and Global Exports

Dec, 1 2025

Dec, 1 2025

India doesn’t just make medicines-it supplies the world. More than one in five pills and vaccines used globally come from Indian factories. For millions in low-income countries, a life-saving HIV treatment, an antibiotic, or a diabetes pill is only affordable because it was made in India. This isn’t luck. It’s the result of decades of strategic policy, disciplined manufacturing, and a relentless focus on cost without cutting corners on quality.

The Birth of a Global Powerhouse

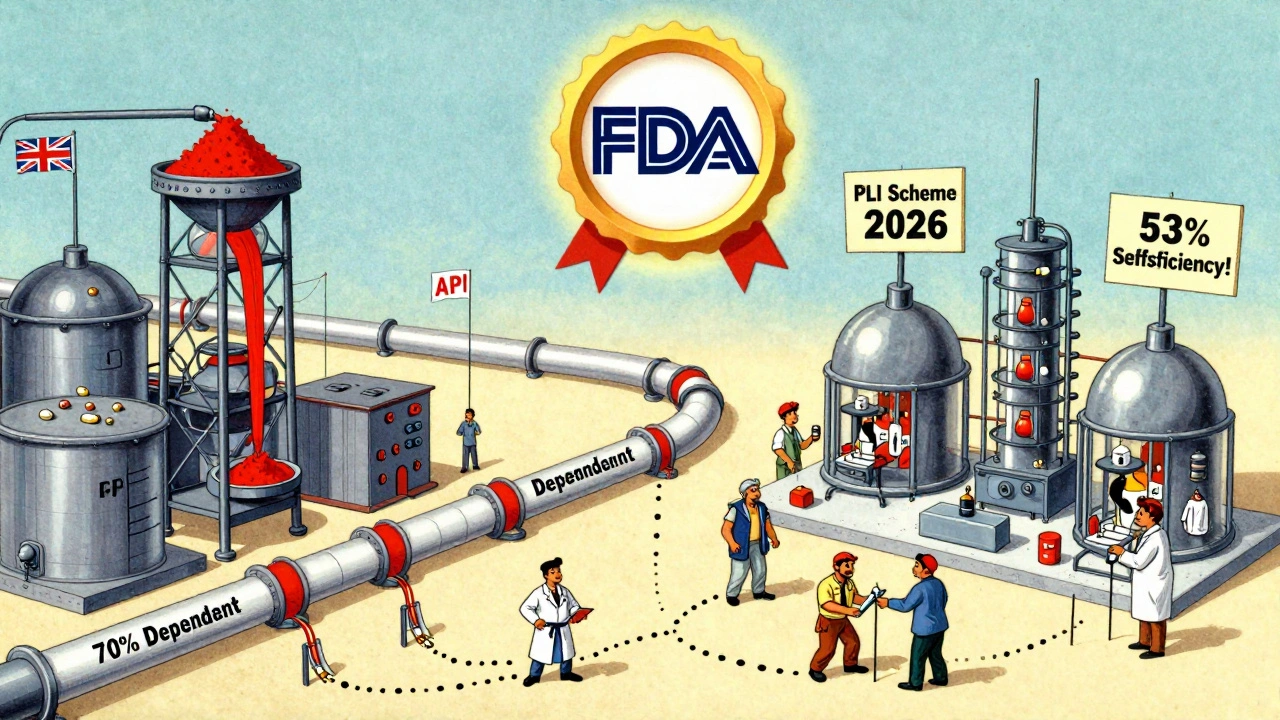

In the 1970s, India changed the rules. It passed a new Patents Act that allowed local companies to copy branded drugs once the original patent expired. No more waiting. No more paying Western prices. Indian firms could reverse-engineer medicines and sell them for a fraction of the cost. This wasn’t piracy-it was public health policy. The goal? To make essential drugs accessible to its own population first, then to the world. That decision turned India into the world’s largest producer of generic drugs by volume. Today, over 60,000 generic medicines are manufactured in India. More than 500 active pharmaceutical ingredients (APIs) are produced domestically. And while the country still imports about 70% of its APIs from China, it’s working hard to fix that. In 2024, the government launched a ₹3,000 crore ($400 million) incentive program to boost local API production, aiming for 53% self-sufficiency by 2026.Who’s Making the Pills?

India’s pharmaceutical sector isn’t made up of small labs. It’s a network of more than 10,000 manufacturing units and over 3,000 companies. A handful of giants dominate the export market:- Sun Pharma: The largest Indian pharma company by market cap, with over $43 billion in value. It exports to more than 100 countries and invests 6-8% of revenue into R&D.

- Cipla: Famous for bringing down the cost of HIV antiretrovirals from $10,000 per patient per year to under $100. Still a major supplier to global health programs.

- Dr. Reddy’s Laboratories: A leader in complex generics and biosimilars, with over $12 billion in market value and a strong presence in the U.S. and Europe.

Why the World Relies on India

The U.S. gets 40% of its generic drugs from India. The UK gets one-third of its generics from Indian manufacturers. In Sub-Saharan Africa, nearly half of all medicines are sourced from India. Why? Three reasons: cost, compliance, and capacity. Indian generics are typically 30% to 80% cheaper than branded versions. A pack of generic metformin for diabetes might cost $2 in India and $15 in the U.S. But here’s the catch-quality isn’t compromised. India has 650 U.S. FDA-approved manufacturing plants. That’s more than any other country outside the U.S. It also has over 2,000 WHO-GMP certified facilities. These aren’t just paper certifications. They’re hard-won approvals after rigorous inspections. In 2015, only 60% of Indian plants passed FDA inspections. By 2024, that number jumped to 85-90%. Former FDA Commissioner Dr. Margaret Hamburg called it a “dramatic improvement.” The industry now uses electronic common technical documents (eCTD) for submissions-92% of manufacturers do, up from almost none a decade ago.

Where the System Still Strains

Despite its strengths, India’s pharma industry isn’t perfect. The biggest vulnerability? Its dependence on China for APIs. Nearly 70% of the raw materials used to make medicines in India come from China. That’s a supply chain risk. When China shut down during COVID-19, drug shortages hit the U.S. and Europe. India responded by launching the PLI scheme-but changing supply chains takes years. Another issue: value versus volume. India makes the most pills by volume, but earns only about 10% of the global generics market by revenue. Why? Because it sells low-cost, high-volume products. A generic blood pressure pill might sell for $0.05 in Africa. In contrast, a European manufacturer might sell a similar pill for $0.50-but only because it’s branded or packaged for a wealthier market. There are also quality control gaps. In 2025, The Bureau of Investigative Journalism reported cases of dangerous Indian-made drugs causing harm abroad. These cases are rare-less than 0.1% of total exports-but they erode trust. Patient complaints on platforms like Trustpilot mention inconsistent packaging, shipping delays, and occasional taste differences in oral suspensions. One Reddit user in 2024 shared a thread about a batch of Indian-made levothyroxine (thyroid medication) with inconsistent dissolution rates. That’s not a manufacturing flaw-it’s a batch variation issue. But for someone relying on that drug daily, it’s life-changing.Exports to the World

India’s export footprint is massive:- 20% of global pharmaceutical exports by volume

- 40% of U.S. generic drug supply

- 33% of the UK’s generic medicines

- 50% of medicines in Sub-Saharan Africa

- More than 60% of the world’s vaccines

The Road Ahead: From Volume to Value

India’s next challenge isn’t making more pills. It’s making better ones. The government’s Pharma Vision 2047 aims to turn India into a $190 billion export economy-not by selling cheap tablets, but by exporting high-value biosimilars, complex generics, and novel drug delivery systems. Companies like Biocon and Dr. Reddy’s are investing over $500 million each year in biologics. That’s the future. Biosimilars are harder to make, require advanced labs, and can sell for 10-30 times the price of a basic generic. They’re also harder to copy-giving Indian firms a real shot at competing with Big Pharma on innovation, not just price. The U.S. ended India’s GSP trade benefits in 2019, adding tariffs on $5.6 billion in exports. That hurt. But it also forced Indian companies to upgrade compliance systems to stay competitive. Now, the focus is on consistency: 95%+ FDA compliance, zero API supply chain gaps, and global trust.What This Means for You

If you’re a patient in the U.S., Canada, or the UK, you’ve likely taken an Indian-made generic. It’s probably in your medicine cabinet right now. If you’re in Nigeria, Bangladesh, or Peru, your child’s vaccine probably came from India. The system isn’t flawless. There are delays. Packaging errors. Occasional quality issues. But the scale of impact is undeniable. India’s generic manufacturers have saved millions of lives by making the impossible affordable. The real question isn’t whether India can keep making cheap drugs. It’s whether it can become the world’s leader in making advanced drugs-without losing the values that made it the pharmacy of the world in the first place.Are Indian generic drugs safe?

Yes, the vast majority are. Over 650 Indian manufacturing plants are approved by the U.S. FDA, and more than 2,000 meet WHO-GMP standards. Compliance rates have risen from 60% in 2015 to 85-90% in 2024. While isolated cases of quality issues have occurred, they represent less than 0.1% of total exports. Regulatory oversight has tightened significantly over the past decade.

Why are Indian generics so much cheaper?

India eliminated product patents for drugs in the 1970s, allowing local companies to copy branded medicines after patents expired. This lets them produce generics without paying licensing fees. Combined with lower labor and operational costs, this enables prices 30-80% lower than branded drugs. Quality standards remain high because export markets like the U.S. and EU demand strict compliance.

Does the U.S. rely on Indian generic drugs?

Yes. India supplies about 40% of all generic drugs used in the U.S.-more than any other country. This includes common medications like metformin, lisinopril, amoxicillin, and levothyroxine. Indian generics make up nearly half of all prescriptions filled in Medicaid and Medicare Part D programs due to their affordability.

What’s the biggest threat to India’s pharma industry?

Its reliance on China for 70% of active pharmaceutical ingredients (APIs). A disruption in Chinese supply-due to politics, pandemics, or natural disasters-can cause global shortages. The Indian government is trying to fix this with a $400 million incentive program to boost domestic API production, aiming for 53% self-sufficiency by 2026. Until then, it remains the industry’s biggest vulnerability.

Are Indian biosimilars competitive globally?

Yes, and they’re growing fast. Companies like Biocon and Dr. Reddy’s are investing over $500 million annually in biosimilars. India now accounts for 8% of global biosimilar exports, up from 3% in 2020. These drugs, which copy expensive biologics like Humira, are priced 60-80% lower than the originals. They’re approved in the U.S., EU, and Canada, and are rapidly gaining market share in Europe and Latin America.

Can I trust Indian generics bought online?

Buy only from verified online pharmacies that require a prescription and list the manufacturer’s name. Many websites sell counterfeit or substandard drugs labeled as Indian generics. Stick to platforms like PharmacyChecker.com, which verifies the legitimacy of online sellers. Real Indian manufacturers don’t sell directly to consumers-they supply hospitals, pharmacies, and governments.

Joel Deang

December 3, 2025 AT 05:49bro this is wild 🤯 i had no idea my $3 metformin came from india. just saved my ass again. thanks, india. seriously.

ATUL BHARDWAJ

December 4, 2025 AT 16:26650 FDA approved plants. no fluff. just facts. india delivers.

Alicia Marks

December 6, 2025 AT 12:30This is one of those quiet miracles no one talks about. So proud of what Indian pharma does for the world.

मनोज कुमार

December 6, 2025 AT 21:05China controls 70% of APIs. this is a national security risk. stop pretending this is just about cost. its strategic vulnerability. fix it or fall behind

Paul Keller

December 8, 2025 AT 18:16Let’s be clear: India’s pharmaceutical industry represents one of the most successful examples of state-driven industrial policy in modern history. The 1970 Patents Act wasn’t just a legal maneuver-it was a moral imperative that redefined global access to medicine. The fact that we’re still debating whether generics are ‘safe’ while ignoring the 85-90% FDA compliance rate speaks to a deeper failure of Western regulatory narrative control. The numbers don’t lie: 40% of U.S. generics, 50% of African medicines, 60% of global vaccines-all produced under stringent quality frameworks that outperform many domestic U.S. facilities. The real scandal isn’t Indian manufacturing-it’s the profit-driven opacity of Western pharma that keeps prices artificially inflated. India didn’t break the system. It exposed it.

Jay Everett

December 9, 2025 AT 17:37Imagine if every country had the guts to do what India did. 🌍💊 We’re not just talking about pills-we’re talking about dignity. People in Malawi aren’t asking for luxury. They’re asking to live. And India said yes. That’s not business. That’s legacy.

Shannara Jenkins

December 11, 2025 AT 16:14Just had my prescription filled with an Indian generic and honestly? I didn’t even notice the difference. If it works and costs less, why are we still stigmatizing it? 💙

Steve World Shopping

December 11, 2025 AT 17:2570% API dependence on China? Pathetic. India’s pharma is a house of cards built on foreign raw materials. No innovation. Just assembly. You export volume but import weakness. This isn’t sovereignty-it’s dependency with a flag.

मनोज कुमार

December 13, 2025 AT 15:03you think the US is any better? we import 80% of our antibiotics from china too. but we charge $200 for a 30-day supply. you want to talk weakness? look in the mirror. india makes the pills. you make the profits.

Arun kumar

December 14, 2025 AT 12:57you know what’s wild? we used to buy insulin from the US for $100 a vial. now we make it for $3 and sell it to africa. the world changed because someone decided health shouldn’t be a luxury. that’s not just business. that’s humanity.

Elizabeth Grace

December 14, 2025 AT 14:09I used to hate Indian meds cause I thought they were ‘cheap’. Then my mom got her thyroid meds from one and she stopped having panic attacks. Turns out the drug works. The packaging? Yeah, it’s plain. But her life? Not plain anymore. So I’m done judging.

Laura Baur

December 16, 2025 AT 12:16The entire narrative around Indian generics is a dangerous myth perpetuated by neoliberal technocrats who conflate affordability with ethical superiority. While it is true that Indian manufacturers supply a majority of global generics, their economic model is predicated on the exploitation of labor, environmental externalities, and the systematic underinvestment in R&D beyond reverse engineering. The 8% biosimilar export growth is statistically insignificant when measured against the $1.2 trillion global biologics market. Moreover, the FDA compliance rate increase from 60% to 85% is not evidence of systemic excellence-it is evidence of regulatory arbitrage, where companies invest just enough to pass inspections while maintaining cost efficiencies elsewhere. The real threat to global health is not Chinese API dependence-it is the normalization of pharmaceutical capitalism that treats human life as a commodity to be priced, packaged, and exported under the guise of humanitarianism.