How to Save Money on Generic Drugs with Coupon and Discount Card Programs

Jan, 9 2026

Jan, 9 2026

Buying generic drugs shouldn’t feel like a financial gamble. Yet for millions of people in the U.S., even the cheapest versions of blood pressure pills, cholesterol meds, or diabetes drugs can cost $50, $100, or more per month-unless they know where to look. That’s where coupon and discount card programs come in. These aren’t insurance. They’re not government aid. They’re simple, free tools that can slash your out-of-pocket costs on generics by 60% or more-if you use them right.

How discount cards actually work (and why they’re not insurance)

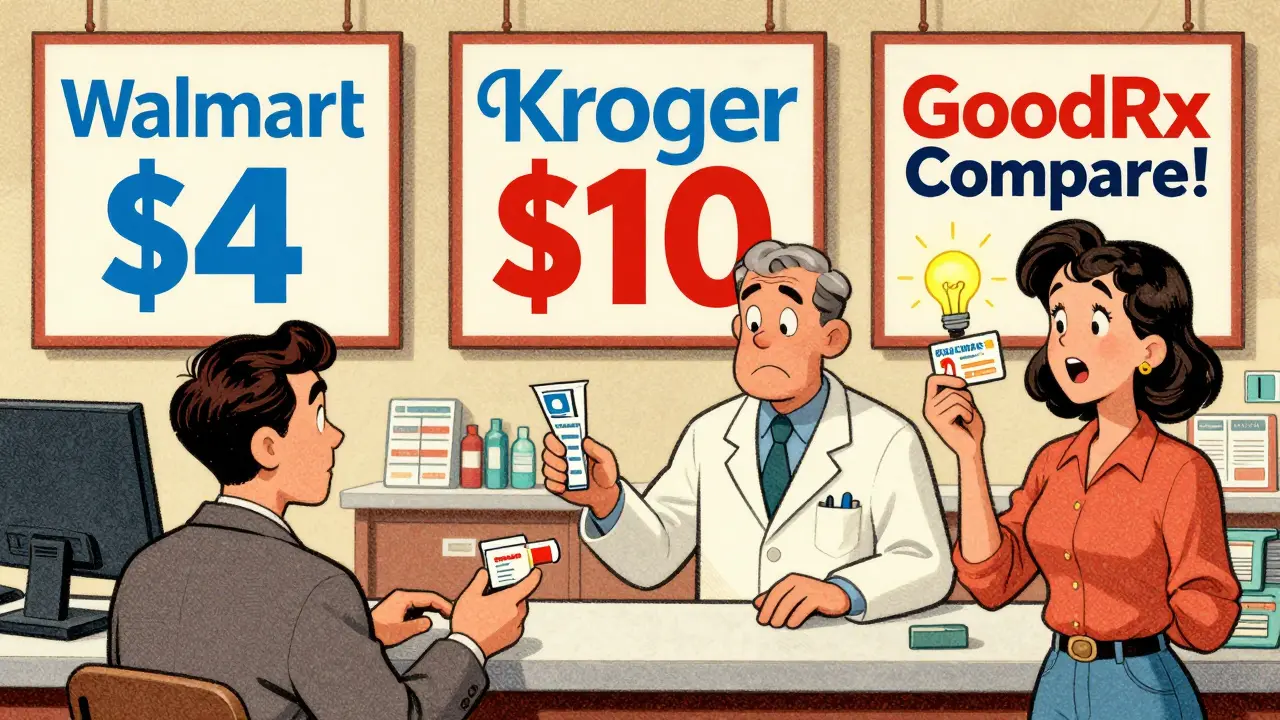

Think of a discount card like a bulk-buying club for prescriptions. Companies like GoodRx, NeedyMeds, and Blink Health negotiate lower prices directly with pharmacies and drug manufacturers. When you show your card-whether printed or on your phone-the pharmacy gives you that pre-negotiated price instead of the regular cash rate. No enrollment. No forms. No credit check. Just hand over the card and pay less. These programs started with Walmart’s $4 generic program in 2006. Suddenly, common meds like lisinopril or metformin were available for $4 for a 30-day supply. Competitors followed. Today, you’ve got pharmacy chains like Kroger and Costco offering similar deals, plus third-party apps that compare prices across hundreds of locations. The key difference from insurance? Insurance pays part of the cost. Discount cards replace the price entirely. If your insurance deductible hasn’t been met, or you’re uninsured, the card price is often the lowest you’ll find.Where the biggest savings happen (and where they don’t)

Not all drugs are created equal when it comes to discounts. For generic-only regimens-like the three-pill combo used to treat heart failure-patients using discount cards report average savings of 65%. That means a $50 monthly bill drops to around $11. Same goes for common drugs like atorvastatin (Lipitor generic), levothyroxine, or amlodipine. Many of these are priced at $4 to $10 for a 30-day supply at major chains. But here’s the catch: if your prescription includes even one brand-name drug, the savings vanish. Take SGLT2 inhibitors for diabetes-brand-name versions like Farxiga or Jardiance. Even with a discount card, you’re still looking at $1,200 to $1,500 a month. The discount? Maybe 10%. That’s not saving. That’s just less of a huge bill. This is why discount cards are best for people who need multiple generics. If you’re on five or six generic meds, you could easily save $300 to $600 a year. But if your doctor prescribes one brand-name drug mixed in, the card won’t help much. You’ll need to look into patient assistance programs or manufacturer coupons instead.The top three discount card programs and how they compare

You’ve got options. Not all cards are the same. Here’s what works best right now:- GoodRx: The most popular. Covers over 70,000 pharmacies. Shows real-time prices from multiple locations. Offers both generic and some brand-name discounts. Has a free app that lets you compare prices side by side. Works well for common generics.

- Walmart, Kroger, Costco: These pharmacy chains have their own $4/$10 generic programs. No card needed-just ask. Prices are fixed. No surprises. But only cover a limited list of generics (usually 300-500 drugs). Best for routine meds like metformin, sertraline, or hydrochlorothiazide.

- NeedyMeds: Not just a discount card. It’s a database of free and low-cost programs, including patient assistance from drug makers. Great if you’re low-income or uninsured. Can help you find programs that give free meds outright.

GoodRx is the most flexible. But Walmart’s $4 list is the most predictable. If you’re on a stable regimen of common generics, stick with Walmart or Kroger. If you need a wider range of meds or want to shop around, use GoodRx.

Why prices vary so much-even at the same pharmacy

You might notice something strange: you get a $12 price for your metformin at CVS today, but next month it’s $22. Same drug. Same pharmacy. What changed? It’s because discount cards don’t set prices. Pharmacies do. And pharmacies get different wholesale rates from different distributors. Plus, some pharmacies pay fees to discount card companies like GoodRx for each transaction. That fee gets baked into the price you see. So one card might show $8 for your pill, another $25. Neither is wrong. One just includes a fee the pharmacy pays to the card provider. That’s why comparing prices across apps is critical. A 2023 Consumer Reports survey found 68% of users had to visit multiple pharmacies to find the best deal. One Reddit user reported paying $15 for the same prescription with Blink Health, but $42 with GoodRx-same day, same store. That’s not a glitch. It’s how the system works.

Who benefits the most-and who gets left behind

If you’re uninsured, on a high-deductible plan, or still paying out-of-pocket before your insurance kicks in, discount cards are a lifeline. For these people, the $4 generic at Walmart can mean the difference between taking meds or skipping doses. But if you have good insurance with low copays, the card might not help at all. In fact, your insurance copay might be cheaper than the card price. A 2023 Ohio State University study found that for insured patients, the discounted card price is often higher than the insurance copay. That’s why pharmacists are now trained to check your insurance first, then the card price, then the cash price-and pick the lowest. The real problem? People who need these cards the most often don’t know how to use them. Health literacy matters. If you don’t understand that generics are just as safe and effective as brand-name drugs, you’re less likely to use the program. Studies show people who believe generics work just as well are three times more likely to use discount cards.How to use a discount card: a simple 5-step plan

You don’t need to be a tech expert. Here’s how to save money in five minutes:- Find your drug: Go to GoodRx.com or download the app. Type in your medication’s name.

- Compare prices: The site shows prices at nearby pharmacies. Look for the lowest cash price-not the insurance price.

- Check Walmart/Kroger: Even if GoodRx says $10, go to Walmart. Their $4 list might cover your drug. Call ahead if unsure.

- Print or save the card: GoodRx lets you email or text a barcode. Or just write down the coupon code.

- Ask for it at the pharmacy: When you hand over your prescription, say: “I have a discount card. Can you apply it?” Don’t assume they’ll know.

Pro tip: Do this every time you refill. Prices change weekly. What was $8 last month might be $15 this month. It’s worth 5 minutes to check.

The hidden cost: time and frustration

There’s no sugarcoating this: using discount cards takes effort. If you’re managing three or four chronic conditions, you’re checking five different drugs, five different pharmacies, five different apps. That’s hours a month. One user on Reddit said, “I spend more time hunting for cheap meds than I do exercising.” That’s why new programs are starting to emerge. Some health plans now automatically apply the lowest price-insurance or discount card-without you lifting a finger. Express Scripts and OptumRx rolled out this feature in 2023. If your insurer uses one of these, you might not need to do anything. Just fill your prescription like normal. But if your plan doesn’t do that, you’re stuck doing the work. And that’s a problem. The Ohio State study found that the complexity of comparing prices causes delays. People skip refills. They run out. Their blood pressure spikes. Their blood sugar climbs. The system saves money-but at a cost to health.

What’s next for discount cards?

The market is growing fast. It’s expected to hit $3.8 billion by 2034. More employers are integrating discount pricing into their benefits. GoodRx now offers telehealth visits so you can get a new prescription and a discount in one app. But the big question remains: can these programs fix the real problem? No. The real problem is that brand-name drugs cost hundreds or thousands of dollars. Discount cards don’t fix that. They only help with the generics. Until drug makers stop charging $1,500 for a pill that costs $2 to make, discount cards will remain a band-aid. But for now, they’re the best band-aid we’ve got.Frequently Asked Questions

Are discount cards safe to use?

Yes. These are legitimate programs backed by major pharmacies and drug manufacturers. GoodRx, NeedyMeds, and others don’t sell your data or charge you anything. They make money when pharmacies pay them a small fee for bringing customers. Your prescription is filled the same way-it’s just priced lower.

Can I use a discount card with my insurance?

You can’t use both at the same time. But you can choose which one gives you the lower price. Always ask the pharmacist to check both. Sometimes your insurance copay is cheaper. Other times, the discount card is. Never assume.

Do discount cards work for all generic drugs?

Most common ones-like metformin, lisinopril, atorvastatin, levothyroxine-do. But not every generic is covered. Some newer generics, or those with limited competition, may not have discounted prices yet. Always check the app before you go.

Why is my discount card price higher than last time?

Pharmacies change their wholesale prices weekly. Also, some discount providers charge pharmacies fees, which can raise the price you see. Always compare prices across apps and locations. What worked last month might not work this month.

Can I use these programs if I’m not in the U.S.?

Most discount card programs like GoodRx only work in the United States. If you’re in New Zealand, Canada, or elsewhere, these won’t apply. But many countries have their own public drug pricing systems or patient assistance programs. Check with your local pharmacy or health authority.

Next steps: What to do today

If you’re paying cash for generic meds:- Download GoodRx now. Search for your top three prescriptions.

- Call your local Walmart and ask if your meds are on their $4 list.

- Next time you refill, ask the pharmacist: “What’s the lowest price I can get?”

- If you’re on a high-deductible plan, check your card prices before your insurance kicks in.

Don’t wait until you’re out of pills. A five-minute search today could save you $200 this month. And that’s not just money. It’s peace of mind.

Jaqueline santos bau

January 11, 2026 AT 04:34OMG I just found out my $120/month blood pressure med is $8 at Walmart?? I’ve been paying insurance copays for YEARS and never checked. I feel like such a sucker. Also, why do pharmacists act like I’m asking them to perform brain surgery when I say ‘Do you have a discount card?’ Like I’m invading their sacred space. I’m not asking for a miracle, I’m asking for $110 back. #WalmartSavesLives

Kunal Majumder

January 11, 2026 AT 10:08Bro in India we don’t even have this problem. Generic meds are dirt cheap here - like 10 rupees for a month’s supply of metformin. But yeah, I get it, US pharma is a total scam. GoodRx is a godsend if you’re stuck there. Just don’t forget to call ahead - some pharmacies don’t even know what GoodRx is. Just say ‘cash price’ and they’ll figure it out.

Aurora Memo

January 11, 2026 AT 17:49I’ve been using NeedyMeds for my mom’s thyroid med since she lost her insurance. It’s not glamorous, but it’s real. I spent hours on the phone with drug companies, filling out forms, and eventually got her levothyroxine for free. It’s not a quick fix, but if you’re in a tight spot, it’s worth the effort. No one should choose between food and medicine. You’re not alone.

chandra tan

January 13, 2026 AT 00:42Back home in Kerala, we buy generics in bulk from local chemists - no apps, no cards. Just walk in, name the drug, pay 50 rupees, done. But I see how chaotic the US system is. Honestly? It’s insane that you need a PhD in pharmacy just to buy a pill. I’m glad someone’s trying to fix it, even if it’s just patching holes with duct tape.

Dwayne Dickson

January 13, 2026 AT 10:20Let’s be clear: discount cards are not a solution. They are a symptom of systemic pharmaceutical malfeasance. The fact that we’ve normalized the practice of consumers becoming price-comparison analysts for essential medications is not innovation - it’s institutional failure. The $4 generic program is a Band-Aid on a hemorrhaging artery. And yet, we pat ourselves on the back for ‘empowering’ patients to navigate a rigged system. This is not healthcare. This is capitalism with a smiley face.

Ted Conerly

January 14, 2026 AT 17:10Just a quick tip: always check GoodRx AND Walmart. I had a friend who swore GoodRx was cheapest - until she walked into Walmart and saw her cholesterol med was $3.50. Same day. Same pharmacy. Just ask. And don’t let them push insurance if you’re on a high deductible. Cash + card often wins. You’ve got this.

Faith Edwards

January 15, 2026 AT 22:38It’s frankly pathetic that a nation with the world’s most advanced medical research cannot provide its citizens with affordable access to life-sustaining generics. The fact that we’ve outsourced our moral responsibility to a third-party coupon app is not ‘resourceful’ - it’s a moral catastrophe dressed in the flimsy clothing of ‘consumer empowerment.’ One cannot be ‘empowered’ when the system is designed to extract, not to heal. Shameful.

Jay Amparo

January 15, 2026 AT 23:40Man, I used to think my dad was being paranoid when he’d call three pharmacies before buying his diabetes meds. Now I do it too. I used to think it was overkill. Turns out, it’s survival. One time, I saved $90 just by switching from CVS to Kroger. I didn’t even know Kroger had a $10 list. Now I tell everyone. It’s not magic. It’s just knowing where to look. And yeah, it’s exhausting. But so is dying early.

Lisa Cozad

January 16, 2026 AT 13:52I started using GoodRx after my husband lost his job. We were paying $80 for his blood pressure med. Found it for $12. We cried. Not because we were happy - because we realized we’d been overpaying for two years. I wish someone had told us sooner. Please, if you’re reading this and you’re on cash - just check. Five minutes. That’s all it takes. You don’t have to be a superhero. Just be a little stubborn.

Saumya Roy Chaudhuri

January 18, 2026 AT 04:27Let me tell you something - if you’re still using GoodRx and not checking NeedyMeds, you’re doing it wrong. And if you think Walmart’s $4 list is the end-all, you’re clueless. There are state-funded programs, church-based pharmacies, and even free clinics that give meds away for free if you ask. You didn’t know? Then you’re not trying hard enough. This isn’t rocket science. It’s basic survival. And if you can’t figure it out? Maybe you shouldn’t be managing your own health.